Odds are, you’ve heard of trusts before — whether you’re a beneficiary, the trustee, or even considered setting one up for yourself. But if you’re like most Americans, that’s probably close to the extent of your knowledge about them.

And especially when it comes to actually setting one up, most people don’t know where to start. It’s not something we learn about in school, and talking about our own death isn’t exactly a fun topic.

But as you grow older, acquire more assets, and are forced to face your own mortality, trusts are something worth understanding. There’s a whole variety of them out there, beneficial in different ways for different people and situations.

We’re here to explain what trusts are, what’s so great about them, and what types are out there. We’ll dive a little deeper into one type in particular — the living trust — and how to set it up as a Georgia resident.

Lastly, we know this is a complex topic and one that most people don’t particularly want to grapple with. We want to hear any questions you have, and as financial advisors, support you in your own path to setting up a trust that works for you.

Table of Contents

What is a trust?

At a high level, trusts are used as a way to minimize estate taxes and reap other benefits that you don’t get with a will. A trust is a legal agreement allowing a third party, known as a trustee, to manage assets on behalf of an appointed beneficiary (or beneficiaries).

They come in a variety of forms and can be arranged in different ways depending on preferences, life circumstances, and other factors. As you’ll see below, what makes them different from a will is synonymous with their benefits…

Perks of setting up a trust in Georgia:

Before we get into the variety of trusts, let’s discuss a few of the potential benefits of setting up a trust in general.

Trusts can provide tax benefits.

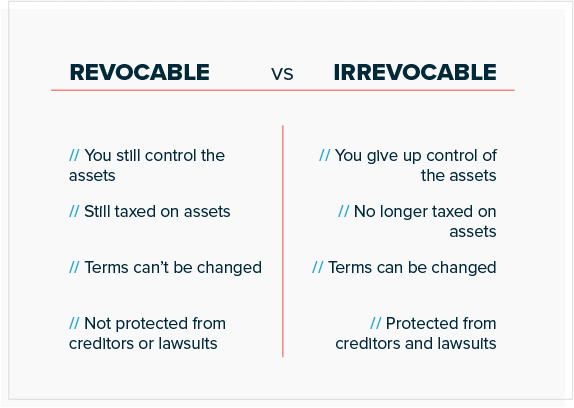

Trusts are either revocable, meaning they can be amended after they’re created, or irrevocable and they can’t. Depending on the terms, revocable trusts might lead to tax advantages later on. But with irrevocable trusts, you’re transferring assets out of your estate, potentially yielding transfer tax benefits.

During your lifetime, contributions to that trust are subject to a gift tax requirement. However, you can also make an additional annual exclusion gift without paying additional gift tax on it — up to $15,000 for individuals and $30,000 for married couples filing jointly.

What’s more, after death, your assets (and their appreciation) placed in an irrevocable trust will be sheltered from estate tax, assuming certain conditions are met.

Trusts enable more flexibility.

With a revocable trust, you may not experience as many tax benefits, but you’re able to amend the terms at any time. Perhaps you have grandchildren or develop a passion for a charitable cause and want those written into the trust.

Revocable trusts make it possible to make these kinds of changes and adjust to life’s unpredictability.

Unlike wills, trusts avoid the probate process.

When dealing with the death of a loved one, the last thing you want is a long, drawn-out process on display to the public. With wills, your asset distribution becomes public record. However, with trusts, the only people you have to involve are your attorney and trustee.

In addition to privacy, avoiding the probate process makes a trust a faster, easier way to distribute your assets when you die.

Revocable trusts can also help during illness or disability.

Wills offer no benefit until the person passes away, but having a revocable trust can provide major support while living. If you become ill or incapable of managing your assets, this can be a huge help to your family taking care of you.

In the event something like this happens, your appointed trustee can take over on your behalf — making distributions, paying bills, even filing tax returns. It’s not a particularly fun discussion to have, but safeguards like this can make all the difference during an already difficult time.

Trusts establish specific parameters for the use of your assets.

And finally, by having a trust agreement, you give yourself the power to customize your estate plan. It’s your trust administrator’s job to walk you through different options, including parameters around asset use and age attainment provisions.

For example, you might want some of the money in your trust to go to your grandchildren for college tuition once they turn 18. Or perhaps you want one of your beneficiaries to receive a limited amount of money every month rather than a large sum all at once.

What kind of trusts can be set up in Georgia?

Now that you know the benefits, let’s get into the variety. We’re a Georgia-based firm, so we’ll keep this list specific to trusts in the Peach State.

Living Trust

When you set up a living trust, you can appoint yourself or another individual as the trustee. The trustee is then responsible for managing your assets on behalf of the beneficiaries.

Unless you include a provision for the trust to terminate on a specific date, it will take effect while you’re alive and continue after you die. These can be revocable or not, depending on whether you want the flexibility of moving assets in and out of the trust.

We’ll dive more into this one in particular once we define the other common trusts available in Georgia.

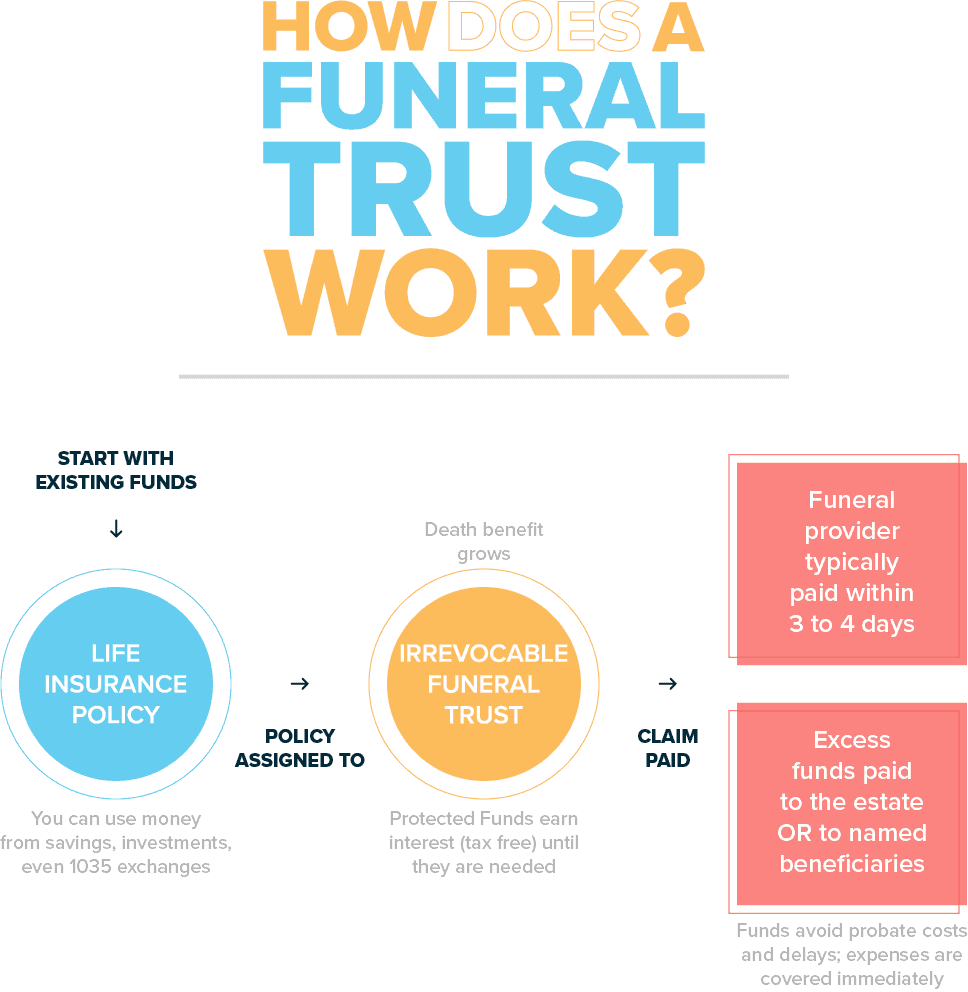

Burial Trust (AKA Funeral Trust)

As the name again implies, this type of trust is used to fund the costs for your burial or cremation when you die. It can be set up as a revocable trust until that time, so its assets can be used for other needs before that.

Educational Trust

Like many of the options out there, this one speaks for itself. The point of having an educational trust is to support a designated individual(s) for education-related expenses.

These can include books, tuition, or supplies, but they usually come with stipulations to avoid being abused. For instance, if the student leaves school prior to graduating, the payments would immediately halt.

Charitable (Remainder) Trust

You can set up a charitable trust to provide tax-free gifts on your behalf. In most cases, the beneficiary would be your spouse and for a certain time period (usually the rest of their life). Then, after your beneficiary’s death, the remaining money would go to a predetermined charity.

Totten Trust

This means that a specific bank account will go directly to a named beneficiary upon your passing.

Testamentary Trust

This is the opposite of a living trust. It means that your trust is created by the terms of your will once you’ve already passed.

Marital Deduction Trust

Many spouses prefer this type of trust because it guarantees that when one spouse dies, the surviving one receives the other’s specifically dedicated property.

Supplemental Needs Trust

This one is particularly helpful for elderly and/or disabled individuals in need of additional income. It offers extra funds while they still remain eligible to receive certain types of public or private benefits. When done properly, this method protects the trust’s funds from being seized by the government or creditors.

Spendthrift Trust

Lastly, spendthrift trusts are designed for those who may no longer be mentally capable of managing their own finances. Another way of looking at it is that it legally keeps critical funds needed for the individual’s support from getting into the hands of creditors.

Now back to living trusts…

Since Georgia’s not a Uniform Probate Code state, it has no obligation to provide grieving families with a swift and simple probate process. To avoid having to deal with probate court, many Georgia residents opt to create a living trust.

They make life easier for the family left behind, allow you to designate yourself or someone else as the trustee, and can be either revocable or not, depending on the flexibility you want.

This means you can pass property down to a trustee until the child for whom it’s actually intended for reaches legal age. It also means you can avoid conservatorship in the event you become incapacitated (because you already assigned a trustee).

Who should set up a living trust?

A common misconception is that you have to be very wealthy to set up a living trust, but that’s really not the case. In fact, the upside to Georgia not having a Uniform Probate Code is that even smaller estates can benefit from living trusts.

Basically, unless the estate has no debts, no will, and somehow all beneficiaries are in agreement on the property distribution, probate is going to get complicated, fast. This is the case even for those smaller estates.

However, the downsides can include being more time-consuming and costly than setting up a will. For example, it’s still a good rule of thumb to have at least $100,000 to be worth the time and expense to set up a trust. And in some cases, they can complicate matters for your heirs due to their larger window for legal challenges once you’ve passed. Contact an attorney to help decide if a living trust is right for you based on your situation.

Steps to setting up a living trust in Georgia:

If you determine that setting up a living trust is in your best interest, here’s what you can expect from the process.

- Decide whether to file a single trust (for single people) or a joint trust (for married couples). Joint trusts hold both spouses’ individual property, as well the assets they own together, such as homes and cars.

- Most of your property, from family heirlooms to stocks and bonds, can go into your trust. Take stock of it all, determine what you want to go in the living trust, and obtain any relevant paperwork (e.g., home deeds, car titles, etc.).

- Assign your trustee. This person will be responsible for distributing your assets when the time comes. You have the option to be the trustee yourself, only having a successor take it over when you die. Or you can choose someone else right away, typically a child or another trusted relative.

- Use an online program or secure the help of a lawyer to draw up the trust document, itself.

- Sign the trust document before a notary public.

- Fund the trust. This is where you actually put the property designated for the trust into the trust, and it’s often advisable to have a lawyer assist.

The Bottom Line

There are many options available when it comes to how you care for the people you love after you pass. It’s a tough topic, but life is unpredictable, and it’s important to be prepared — if not for your sake than for your loved ones’. Trusts can be a valuable way to simplify the distribution of your assets, make the grieving process a little bit easier for your family, and materialize your legacy. If you have questions or need help getting started, we’re here for you. You can fill out a form or give us a call to get started today.

The information in this article is for general informational and educational purposes only, and should not be construed as investment, tax, or other financial planning advice.