Have you ever lost or quit a job? Perhaps you worked for a company that was taken over by another company? Or maybe you’re approaching a long-awaited retirement? Odds are, if you answer yes to any of these, you’ve experienced having to roll over an old retirement plan. What exactly does this mean? We’ll break it all down in this blog.

First things first.

Before we get into the details, let’s walk through some background information on what rollovers are and who might be eligible to take advantage of them.

A rollover, in general, is a pretty easy concept. In its most basic form, a rollover is simply a way to get money from one retirement account to another in the most tax-efficient way possible. That’s actually where the term “rollover” comes from — you’re literally rolling a balance over from one account to another.

Where do you roll it over to? Great question! The two most common destinations are an Individual Retirement Arrangement (also known as an IRA) or another employer-sponsored retirement account. We’ll get into more detail on these later.

Generally, you’re eligible to explore rollover opportunities as long as you (a) have an employer-sponsored retirement account and (b) are no longer employed by the company that sponsors the account (there are also some important exceptions here that we’ll cover later). For rollover purposes, “no longer employed” means you’ve either quit, been fired/let go or retired.

What type of accounts can be rolled over?

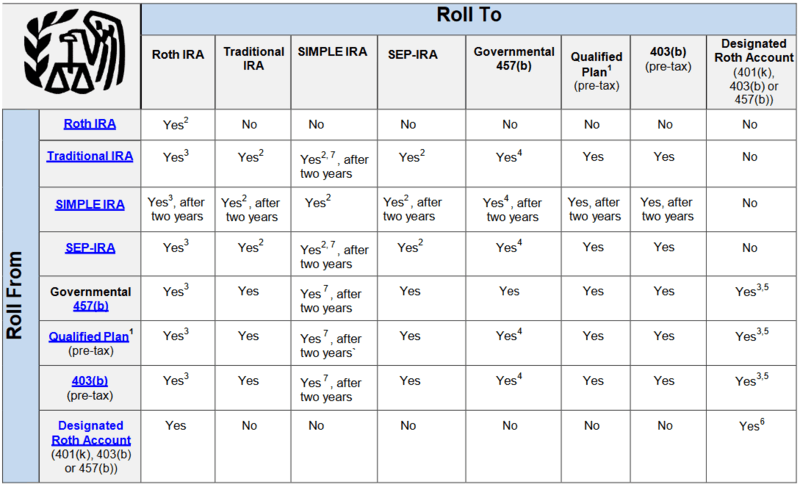

In this guide, we’ll refer to your company retirement plan as an employer-sponsored retirement account, but the truth is that this term can encompass several different types of accounts. The IRS has a chart for this. However, as with much of the IRS-related information, it is not exactly easily digestible.

We’ll highlight a few of the more popular ones below, but know that most of the retirement accounts you have access to as part of a workplace benefits package are eligible for rollovers at some point.

401(k)

Perhaps the most widely known type, 401(k) plans are offered through many for-profit organizations. These may include a matching incentive where the employer will match a portion of the employee’s contributions.

403(b)

403(b) plans are employer-sponsored retirement plans for certain employees of public schools, tax-exempt organizations, and certain ministries.

457

A 457 plan is typically offered through nonprofit organizations and state and local governments. These plans are often used for governmental subdivisions, such as police departments and fire districts.

Thrift Savings Plan

The Thrift Savings Plan (TSP) is a retirement saving and investment plan for federal employees and members of the uniformed services.

SIMPLE IRA

A Saving Incentive Match Plan for Employees (or SIMPLE) is a common type of employer-sponsored retirement plan for small businesses with less than 100 employees. The plan allows for employee deferrals with an employer match.

Situations where you may want to do a rollover:

Scenario 1: You leave your job for a new one at a new company.

You might’ve spent the last several years working for Company A, but have recently decided to take a new job with better pay and/or benefits (yay) working for Company B. You’ve piled away a decent amount of savings in the 401(k) at Company A, but you’re unsure how your impending job change will affect the account.

In this scenario, you have a couple of different options as far as to where your funds can go.

The First Option: Rolling your Company A account over to an Individual Retirement Arrangement (IRA).

This option typically offers the most flexibility in terms of investments and the most control over the potential costs involved. By working with an advisor to facilitate this, you have access to a range of financial planning services that you may not have known about but can come in handy during a job transition.

Why does investment flexibility matter? Well, since most employers offer retirement savings plans as part of their benefits package, these plans are very often subject to review in the event cost-cutting becomes necessary. This can lead to limited investment options within the account, putting the potential growth of your savings at the mercy of the investments to which the company has chosen to give you access.

Moving your account to an IRA can open up an infinite pool of investment options and allow you to take advantage of best-in-class funds.

The Second Option: Rolling the account balance from the 401(k) at Company A to the 401(k) provided by Company B.

You might choose this option if your main concern is simplicity, and you’re not too worried about limited investment options.

Whichever option you choose, there are specific steps you must follow to prevent being hit by unnecessary taxes and/or penalties. Keep reading, and we’ll get into the details on how to manage this soon.

Scenario 2: You lose your job, whether from being fired or let go.

This one’s more of a bummer, but ultimately provides a similar opportunity to explore rollover options.

The difference between this and the first scenario is that, unless you’ve already found a new job, you likely won’t have the ability to roll the funds from the employer-sponsored retirement plan you’re leaving to a new one. In this instance, your only option would be to roll the funds over to an IRA.

If you’ve got an advisor, this is a perfect time to give them a call. They’ll be able to help set up the IRA to receive the rollover, as well as initiate the rollover process with the former account custodian. They’re also equipped to address any budgeting concerns that you may have due to the loss of income.

One major benefit of leveraging rollovers post-job loss is the ability to get organized.

Rather than having several accounts spread out across various former employers, rollovers allow you to consolidate into something more manageable (and lucrative).

Scenario 3: You’ve reached retirement.

When you retire, it’s generally a good idea to position your retirement savings in a way that gives you maximum control over costs and available investment options. Rollovers fit the bill for many people reaching this point in life.

The organization benefit we mentioned above applies to this scenario as well. It’s good practice to have all your accounts in a place where you can easily monitor them.

The exception here is for anyone with a 401(k) that might be retiring in the window between age 55 and the IRS’s magic age of 59 ½ (when early withdrawal penalties no longer apply). For those in this bracket, rolling over the entire balance may not be advisable in case you need to withdraw any funds before age 59 ½.

There is a special regulation by the IRS that allows for early (before age 59 ½) distributions from 401(k) and 403(b) plans without having to pay the early withdrawal penalties. It’s called the Rule of 55.

With all the rules and regulations that come into play, this is also a good time to consider working with a financial advisor if not already. Having an expert on your side who’s done this before and knows the ins and outs could make all the difference in your retirement.

Bonus Scenario

This one’s a bonus because it’s not terribly common, and it does require specific permissions from the custodian of the employer-sponsored plan.

This particular rollover is called an in-service withdrawal: a distribution from an existing employer-sponsored retirement account while you’re still employed by the company.

“But I thought you had to be separated in order to be eligible for a rollover?” You do — except for in this one instance.

Most of the time, in-service withdrawals are done by people who might be close to retirement and want to get their ducks in a row before officially retiring. The distribution is usually sent to an IRA that will eventually serve as the source of income once retirement is official.

Your advisor can walk you through the pros and cons of your specific situation when it comes to in-service withdrawals.

How do retirement plan rollovers work?

Now that we’ve established the what and why, let’s dive into the actual process of rolling your funds out of an employer-sponsored retirement account and into something different.

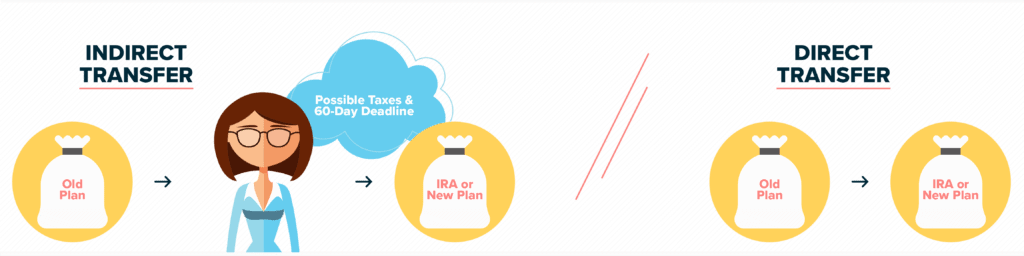

There are two types of retirement plan rollovers – indirect and direct. Direct rollovers are more, well, direct in their process and, as such, are pretty hands-off once initiated. Indirect rollovers can introduce some complexity in the process, and if not done correctly, can lead to taxes and/or penalties. For these reasons and more, direct rollovers are often advised over their indirect counterparts.

Direct Rollovers

The first step in any rollover process is always to contact the employer-sponsored retirement plan custodian. If you’re working with an advisor to facilitate the transfer to an IRA, they can easily help you with this. There are a couple of reasons to tackle this step first: 1) you need to verify that your previous company has informed the custodian that you’re no longer employed (unless the rollover is an in-service withdrawal), and 2) you need to make sure you have properly completed all of the required paperwork necessary to complete the rollover.

A good rule of thumb is to wait about two weeks after your last day of work before contacting the retirement plan custodian to initiate the rollover process. If you’re not working with an advisor, most custodians will help you with the necessary paperwork, and some can even complete all the steps over the phone.

They’ll ask some questions about where the retirement funds are going (including the name of the receiving custodian and any IRA account numbers, if applicable), and then they should give you a rough time frame for when to expect the rollover to be complete.

In a direct rollover, the retirement plan custodian will normally send the funds directly to the new custodian via mail or electronic transfer. In the event the custodian can’t send it directly, they will typically mail you a check that you’ll need to forward to the new custodian in a timely manner. The rollover is not considered complete until the new custodian receives the funds and credits them to the new account.

Indirect Rollovers

Even with indirect retirement plan rollovers, it’s still important to contact the retirement plan custodian to start the process. The steps will be similar, but there are some important (and possibly costly) differences.

With an indirect rollover, the retirement plan custodian will make the distribution check payable to you (as opposed to the new qualified account as with direct rollovers), and you will be responsible for forwarding it to your new account within 60 days.

According to IRS rules, the custodian distributing the funds is required to withhold 20% of the account balance for taxes anytime an indirect rollover is done. So if you’re trying to do an indirect rollover with an account balance of $10,000, just know that the custodian will withhold $2,000 of that and send you a check for $8,000.

Everything makes sense so far? Well, let’s complicate it a little further.

Let’s say you roll over the check for $8,000. You’ll still need to report the $2,000 that the custodian withheld as both taxable income and taxes paid. Plus, if you’re under the age of 59 ½, you’ll also get an extra 10% penalty on that $2,000 (unless you qualify for an exception).

Now if you wanted to indirectly roll over the full $10,000 value of the account, you’d have to find another $2,000 cash to put with the $8,000 check to make up for the withheld amount. If you do this, you’d only need to report the $2,000 withheld by the custodian as taxes paid (and not as taxable income as well).

Something to keep in mind — you can only do one indirect rollover in any given 12-month period of time.

Now you can see why direct rollovers are far more preferred over the indirect route. Less moving parts, less room for error.

What should I know about doing a retirement plan rollover?

Rollovers are normal.

The first thing to know about rollovers is that they are perfectly normal and extremely common. When done properly, whether on your own or with the guidance of an advisor, rollovers don’t have to be something to fear.

Change is always hard, and that’s especially true when it comes to finances, but as long as you know ahead of time what to expect and follow the process outlined by your custodian, you and your money will be in good shape.

Rollovers should be handled carefully.

Although rollovers are perfectly commonplace, you should still take time to understand and follow the guidelines to prevent unexpected fees and ensure nothing goes wrong.

Pursuing a rollover without a gameplan or the knowledge of an advisor who’s done it before can potentially cost you.

401k loans may play into it.

Another item to consider is how outstanding 401(k) loans might impact your ability to roll over employer-sponsored retirement plans.

If you have them, you know that when you take loans from your 401(k), you’re typically required to pay them back with monies from your paycheck(s). This can present a challenge if you retire or leave your job and plan to do a rollover.

The short answer to this dilemma is that the 401(k) loan just has to be paid back before the money in the retirement account can be transferred out. A trusted advisor will be able to walk you through what this means for your specific situation.

Doing this on your own? Make sure you know what you’re doing because a wrong move could trigger taxes, penalties, or both.

The Bottom Line

At the end of the day, you worked hard for your money, and you want to hold onto as much of it as you can. However, life happens, things change, sometimes they’re planned, and sometimes they hit you by surprise.

In any case, you want to be prepared, so if you lose a job, switch careers, or retire down the line, you know your options. This guide’s a great start, but if you have questions or simply feel more comfortable having an expert on your side, that’s what we’re here for. Fill out a form or give us a call directly, and we’ll be there to advise you every step of the way.

The information in this article is for general informational and educational purposes only, and should not be construed as investment, tax, or other financial planning advice.